Post with embeds

twitter2

captionedImage

button

bullet_list

Macro structure: HODLer buying has soften recently with this month’s price pull back, however long term holders remain in a region of peak accumulation. Structurally we are still in a bullish macro region. Despite bearish price action the underlying structure has no signs of a bear market.

Short term: HODLers have been buying the dip. Coins are moving off the exchanges. Coins held by HODLers have been rising, recovering from recent weakness. Our on-chain Supply Shock valuation model implies BTC is presently trading at a $6k+ discount.

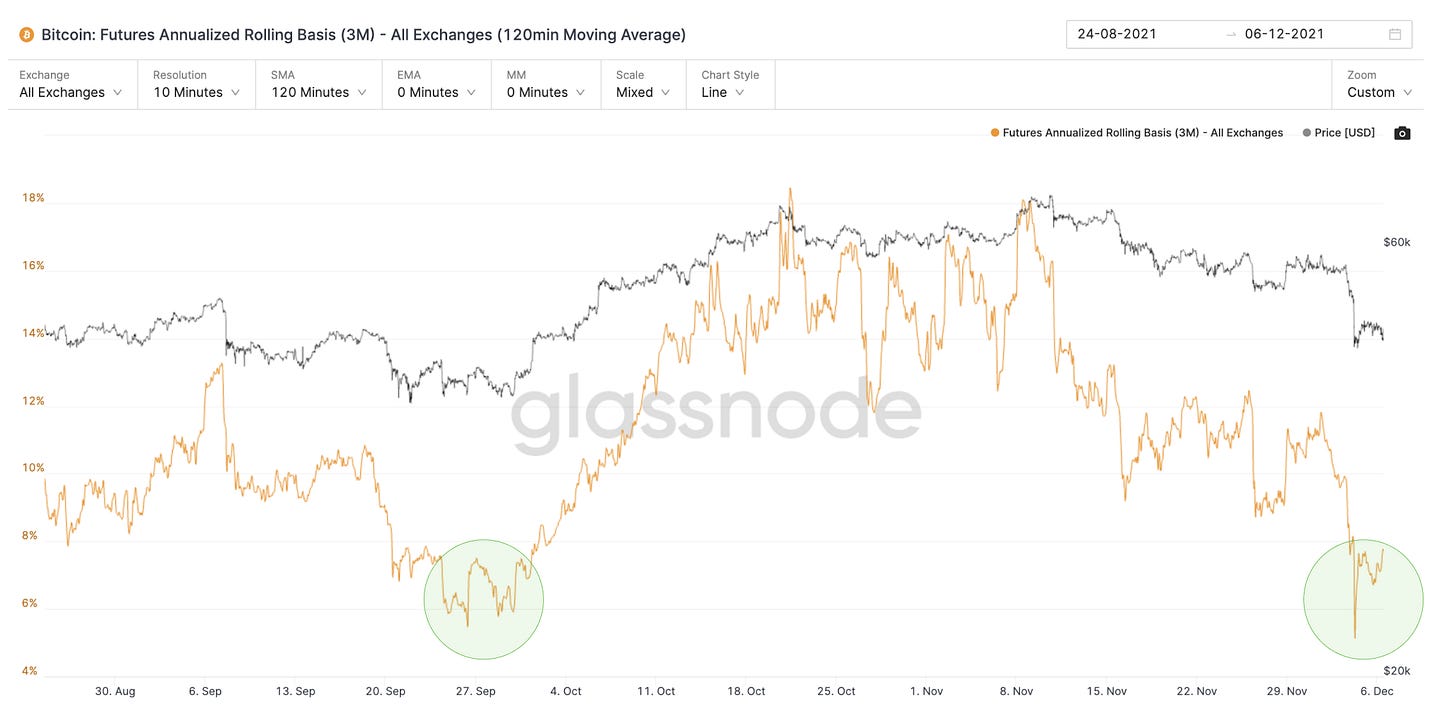

Data from derivative exchanges is showing an uptick in demand, a bullish divergence has formed suggesting the bottom may be in.

BTC price action expectation: Price recovery from lows with further consolidation over the weeks of December.

Price action conviction: Medium.

blockquote

Scenario 2: OPEN below 4504. I think this scenario could be bearish one especially if we fail to take out 4504 within the IB period + trade below 4480. IB is the first hour of trade. In this case my target will be 4462. An impulse move may test NFP lows around 4440.

youtube2

horizontal_rule

ordered_list

If that was not enough, there is a lot of news flow and event risk. At this point, a strong NFP is a liability. A weak NFP may be good for stocks but should not be at the cost of sagging wage inflation.

Expecting balance conditions unless a close above or below my 4536 or 4480.

embeddedPost

subscribeWidget

spotify2

opensea

image2

vimeo

footnote

What is this strange sensation? Why does this man think everything will work out? Where is the doom and crushing morosity? How does he live like this?

paragraph

THIS NEWSLETTER IS COPYRIGHT © 2021 BY UNIQUE TEXT OFFERINGS (HK) LTD. ALL RIGHTS RESERVED.